Deltamodel

a structured approach ...How much capital do you need to live on?

Introduction

The question of how much wealth is needed to live on can be broken down into two factors, which are very individual for each person, and a basic formula in which the two factors are used. The basic assumption in each case is that the assets should not be depleted, but that the income from the assets should cover the required amount.

This article is not about how you can earn the wealth you need or how long it will take you to earn the amount you need. This article is about introducing you to a simple method that will help you figure out how much wealth you need if you want to withdraw a certain amount from that wealth on a permanent basis.

The two factors to determine the necessary amount of money

Two factors determine the required capital to a large extent. Both factors are individual for each person and can change depending on life situation and personal demands.- How much money is needed to live

- How high is the expected consumable return

Factor 1: How much money do you need?

The first question you should answer is how much money you need each month for your desired lifestyle. This question is very individual and will lead to different answers for different people depending on their life situation and expectations. As an example, for this article we will assume an amount of 3000 EURO. Among the largest cost items that must be covered with this amount for a person are certainly:

- the cost of housing (e.g. rent and utilities).

- the costs of personal mobility (e.g. a car)

- the cost of maintaining personal health (e.g., health insurance and long-term care insurance)

- the cost of food

- the cost of clothing

- the costs for entertainment (e.g. cinema, going out)

- other costs if not covered by the already mentioned items (e.g. cell phone, internet, unexpected events)

Factor 2: What is the consumable return?

The second of the two factors is how much of a- realistic,

- reliable and above all

- consumable

return you expect.

This question may also lead to different answers depending on several aspects, e.g. risk tolerance. If you assume that you want to generate a reliable cash flow from dividends and understand the desirable annual dividend growth as a buffer for inflation compensation as well as appreciation of your investments as an additional safety net, a consumable net return of 2.5% after tax might be a valid assumption.

Calculation of the necessary capital

In order to convert these assumptions into a usable formula, it is plausible to assume that at the beginning of each year you withdraw the amount required for the year from your invested capital. You consume this amount and reinvest the income accruing in the course of the year directly or save it as a basis for the required amount of the next year.

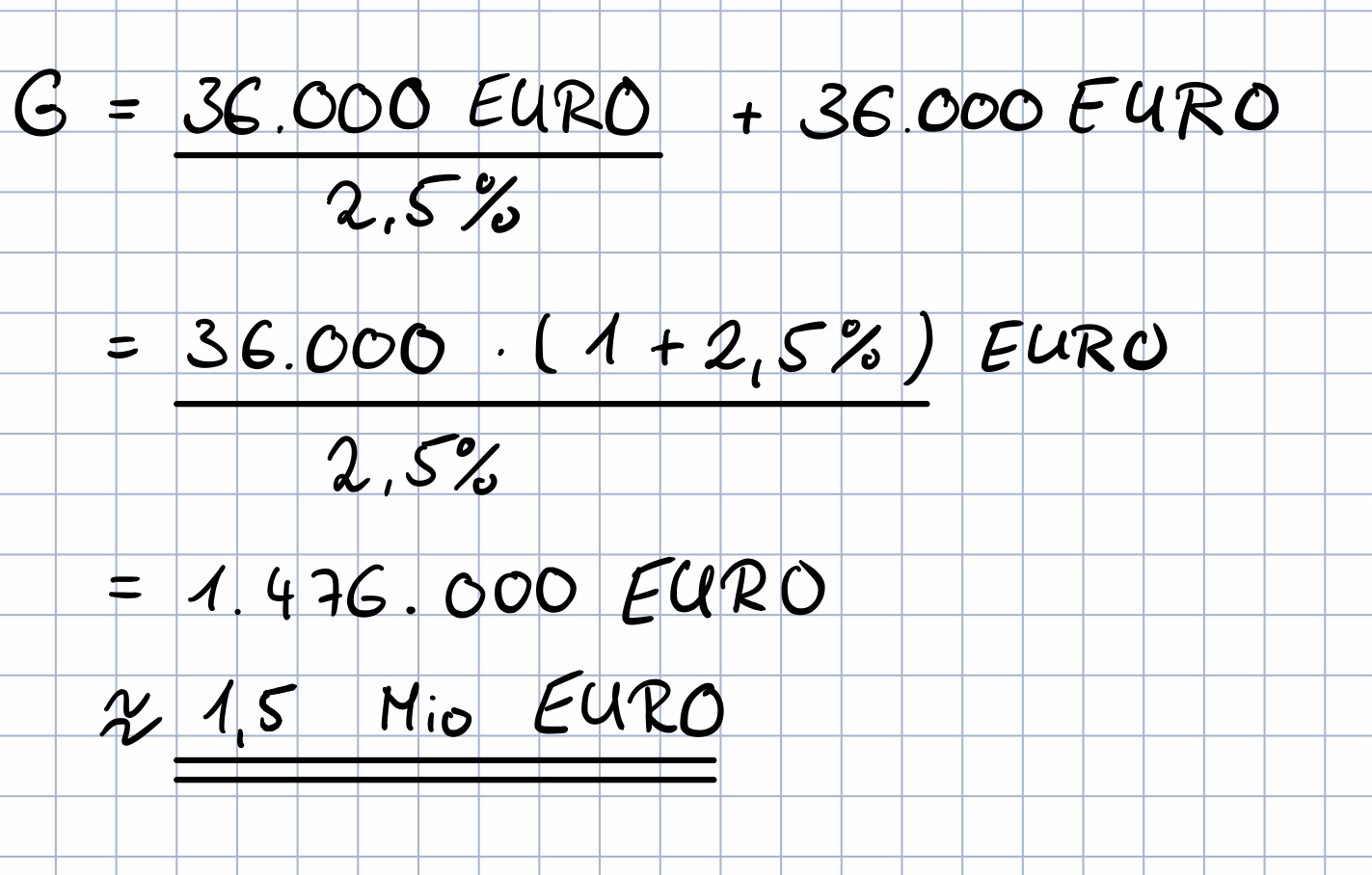

3000 Euro per month add up to 36000 EURO per year. In order to be able to consume this amount permanently and year after year, you want to ensure accordingly that your capital after the withdrawal at the beginning of the year again generates these 36000 euros with the expected return.

From this it follows that with a capital requirement of 36000 Euro and a consumable return of 2.5% you have a total capital G of about 1.500.000 EURO.

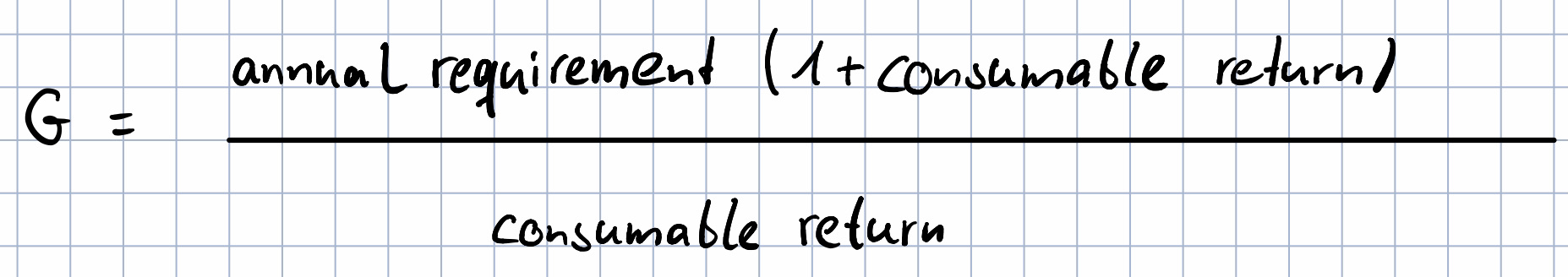

From this example calculation you can easily derive the general formula, viz.

Based on this formula, the total capital required is tabulated depending on various assumptions for the consumable return and for the annual requirement, and the result for a requirement of 36000€ and 2.5% consumable return green is highlighted.

| 1.5% | 2% | 2.5% | 3% | 3.5% | 4% | 4.5% | 5% | |

|---|---|---|---|---|---|---|---|---|

| Example values for G as a function of consumable return and annual requirement. | ||||||||

| 12,000€ | 812,000€ | 612,000€ | 492,000€ | 412,000€ | 354,857€ | 312,000€ | 278,667€ | 252,000€ |

| 24,000€ | 1.624,000€ | 1,224,000€ | 984,000€ | 824,000€ | 709,714€ | 624,000€ | 557,333€ | 504,000€ |

| 36,000€ | 2,436,000€ | 1,836,000€ | 1,476,000€ | 1,236,000€ | 1,064,571€ | 936,000€ | 836,000€ | 756,000€ |

| 48,000€ | 3,248,000€ | 2,448,000€ | 1,968,000€ | 1,648,000€ | 1,419,429€ | 1,248,000€ | 1,114,667€ | 1,008,000€ |

(cautious) interpretation of the results

While the formula itself is relatively easy to understand, it is more difficult to determine its results as a function of different values for the two factors of demand and consumable return.

36,000€ annual requirement

For many people, 36,000€ is probably an immensely high sum that is sufficient for a comfortable lifestyle. However, it should not be neglected that the 36,000€ is not a typical employee net salary. Rather, the 36,000 euros would also have to fully cover the costs of social security contributions (especially health insurance and long-term care insurance), which would typically be covered proportionately by the employer.

On the other hand, it depends on the desired lifestyle whether 36,000 euros may not be too little money. Presumably, however, it is the case in Germany and thus also in most regions of the world that such an amount is sufficient as a basis for a lifestyle that is quite acceptable compared to the population as a whole.

If additional income can also be assumed, the lifestyle improves with each additional euro earned or the absolute required consumable return drops to possibly well below 36,000€.

Examples of additional income could be:- Entitlements from the statutory pension

- Secondary income from (ideally socially insured) activities.

2.5% consumable return

Furthermore, depending on personal thought patterns and beliefs, 2.5% consumable returns would be unrealistically high or much too low. At least for globally diversified stock portfolios it can be plausibly assumed on the basis of historical returns that even a withdrawal of 4% does not necessarily have to result in a total loss, but can happen significantly often (

Trinity Study

) while preserving or even increasing the total capital.

There are no guarantees for the future based on past returns, however 2.5% consumable return seems conservative rather than overly optimistic.